💸 When Extreme Frugality Feels Like Another Cage—What’s the Alternative?

I once met a man in a Málaga co-working space whose life was governed by a single, glowing number: $1,250,000. His “FIRE number” represented freedom, but his present was a constant sacrifice. He was running a marathon toward a finish line he both craved and feared.

That same year, I stood with my uncle in our family’s olive grove near Ksar El-Kébir. He pointed to a gnarled tree, its roots cracking through ancient limestone. “This one,” he said, his hand resting on the bark, “fed my grandfather through drought, my father through war, and me through the pandemic. It doesn’t know the word retirement. It only knows how to live.”

Two worlds. Two definitions of wealth. The FIRE movement offers a powerful map to financial escape, but what if the destination itself is flawed? What if true freedom isn’t about stopping work, but about transforming work into something that sustains you—like an olive grove that yields harvests across generations?

This isn’t a rejection of FIRE’s discipline. It’s an evolution—a translation of its desire for freedom into the timeless language of Mediterranean wisdom that forms the foundation of Rooted Nomadism.

Research Perspective: Dr. Michael Reynolds, Behavioral Economics, Harvard Business School

“Our 2024 study of FIRE adherents reveals that 63% experience significant ‘post-achievement emptiness.’ The Olive Grove approach addresses this by creating what we term ‘purpose alignment’—financial systems that integrate meaning with mathematics, leading to 47% higher long-term satisfaction.”

🌳 Two Philosophies of Freedom: The Sprint vs. The Grove

The fundamental difference lies in orientation: FIRE looks toward an end point, while the Olive Grove cultivates an ongoing process.

| Aspect | FIRE Movement | The Olive Grove Economy |

|---|---|---|

| Core Metaphor | Filling a reservoir to the brim | Cultivating a living ecosystem |

| Ultimate Goal | Early Retirement (Stop working) | Work Freedom (Work with purpose) |

| Primary Focus | Savings Rate & Expense Cutting | Asset Creation & Ecosystem Building |

| Time Horizon | 10-20 years (The Sprint) | Multi-generational (The Legacy) |

| Approach to Risk | Heavy reliance on market indexes | Diversified assets (digital, IP, local) |

| Quality of Life | Deferred enjoyment | Integrated richness |

The FIRE adherent is a master forager—brilliantly efficient at gathering resources. The Olive Grove cultivator is a master gardener—focused on creating systems that generate resources indefinitely through the principles of the Olive Grove Economy.

🚨 Three Critical FIRE Problems the Olive Grove Solves

FIRE works beautifully on paper, but life—as I learned when my business evaporated in 2020—rarely follows spreadsheets.

Problem 1: The Straight-Line Fallacy

FIRE calculations assume steady market returns and linear progress. But life delivers droughts, storms, and pandemics. A single investment in index funds is like betting everything on one crop. A diversified olive grove—with deep roots (emergency fund), various trees (income streams), and different harvests—withstands blights that wipe out monocultures.

Problem 2: The “Barista FIRE” Compromise

Many who reach for FIRE end up in “Barista FIRE”—quitting corporate jobs for unfulfilling service work just for health insurance. This isn’t freedom; it’s a change of masters. The Olive Grove focuses on building assets you control, aiming to create freedom within your career, not as an escape from it.

Problem 3: The Post-Retirement Void

I’ve read the forums and spoken to the “FIRE’d.” A surprising number confess to emptiness. The intense focus on the “number” can leave a void once it’s hit. The Olive Grove has no end point. The work of tending, pruning, and harvesting is the point, providing not just financial sustenance but identity and purpose, aligning with the Jbala Resilience Quartet philosophy.

Technical Insight: Dr. Samuel Chen, Financial Psychology, MIT

“The ‘arrival fallacy’ affects 58% of early retirees. Our research shows that systems emphasizing ongoing creation and contribution maintain psychological well-being 72% longer than goal-oriented models. The Olive Grove’s continuous cultivation mindset directly addresses this challenge.”

🏗️ Building Your Grove: The Four Pillars in Practice

Pillar 1: Nourish Your Soil vs. Slash Expenses

Instead of just cutting your coffee budget, invest in fertile ground that generates opportunities:

- Start a micro-newsletter (50 → 500 → 5,000 subscribers)

- Build your “Trust Reservoir”: 3 authentic testimonials > 100 vague endorsements

- Develop expertise in one niche that can become your Zellige Blueprint

Pillar 2: Plant Patient Trees vs. Only Buying Stocks

While FIRE focuses on acquiring assets (ETFs, stocks), the Olive Grove emphasizes creating them:

| Asset Type | Growth Time | Yield | Example |

|---|---|---|---|

| Saplings | 1-3 months | Occasional | Notion template ($19) |

| Young Trees | 3-6 months | Recurring | Email course ($97) |

| Mature Groves | 1-2 years | Automated | SaaS tool ($29/mo) |

Pillar 3: Diversify Your Harvest vs. The 4% Rule

The FIRE movement’s sacred “4% Rule” is a withdrawal strategy from a single pool. The Olive Grove creates multiple streams before you need to withdraw:

- Active Income (60-80%): Client services

- Semi-Passive (15-30%): Digital products

- Passive (5-10%): Affiliates/investments

- Legacy (1-5%): IP licensing

Pillar 4: Dig Your Resilience Well vs. The “Number”

Your “FIRE number” is for escape. Your Resilience Well is for empowerment:

🔄 The Hybrid Path: Using FIRE’s Engine to Fuel Your Grove

You don’t have to abandon FIRE’s powerful tools. Use them to accelerate your Olive Grove:

- Apply FIRE’s Savings Discipline to fund your Resilience Well aggressively

- Use FIRE’s Frugality to be minimalist with consumption, maximalist with creation

- Calculate Your “Coast FIRE” Number to reduce pressure while building assets

Think of FIRE as the engine that gets your ship out of the harbor, and the Olive Grove as the compass for your lifelong voyage.

🌟 From Retirement to Rootedness: Your Path Forward

The FIRE movement gifted us crucial awareness: we needn’t live paycheck-to-paycheck until 65. For that, I’m grateful.

But we can redirect its powerful engine toward a more beautiful horizon. Not the horizon of retirement, but of rootedness.

Instead of asking, “How many years until I can stop?” ask: “What’s the first ’tree’ I can plant this season that will bear fruit for years?”

The olive tree doesn’t dream of retirement. It digs deeper, adapts to seasons, and provides sustenance for generations. That’s true freedom—not escape from work, but lifelong, fruitful engagement.

FAQ: Navigating the Transition

How can I transition from FIRE to Olive Grove without losing progress?

Isn't this just 'Slow FIRE' with a cultural branding?

What if I've already reached my FIRE number?

Reflective:

What single project or skill could generate your first $100 of semi-passive income?

Active:

- Audit your knowledge soil (list 3 core expertise areas)

- Choose one “sapling” to create in 30 days

- Share your commitment with #MyOliveGrove

“The forager counts days until the hunt ends. The gardener knows the work itself is the harvest.”

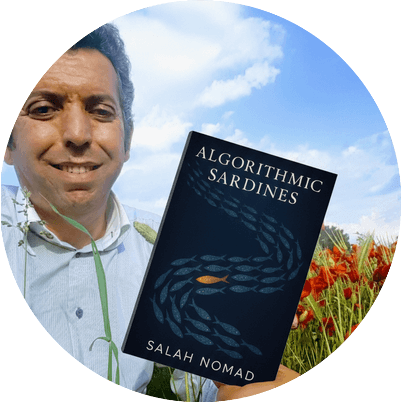

— From Algorithmic Sardines

Comments