💸 When Your Business Vanishes Overnight—What Ancient Wisdom Offers Rescue?

March 16, 2020. Tangier’s port lay unnaturally still. The scent of Rif mountain clay—the earthy perfume of my livelihood—hung trapped in locked shipping containers. Thirty-seven cancellation emails glowed accusingly on my screen. In 48 hours, my entire business had vaporized.

I drove to Ksar El-Kébir through villages frozen mid-breath. At our family olive grove, I pressed my forehead against an ancestor-planted tree. Its bark felt like cooled lava, etched with centuries of droughts and invasions. “How do you survive?” I whispered. The wind answered through silver leaves: “You measure wealth in roots, not fruits.”

That epiphany birthed this truth: Digital nomads obsess over cash flow (fruits). True freedom grows from assets (roots). This is the heart of the Olive Grove Economy, a framework that saved me and can transform your financial resilience.

Research Perspective: Dr. Michael Reynolds, Digital Economics, Harvard Business School

“Our 2024 analysis shows that professionals with diversified income streams weathered the pandemic 73% better than those relying on single sources. The Olive Grove Economy principles align with what we term ‘antifragile financial architecture’—systems that strengthen under stress.”

🌳 What 4 Ancient Principles Can Transform Your Financial Future?

Principle 1: Nourish Your Soil—Build Foundational Platforms

The Olive Wisdom: Olive trees don’t grow in barren ground. They need rich, well-tended soil. Phoenician merchants built ports, not just boats—their infrastructure attracted trade naturally.

Modern Application:

Your digital “soil” is the foundation that attracts opportunities. Start building your platform before you need it:

- Begin with a micro-newsletter (50 subscribers → 500 → 5,000)

- Repurpose one client project into foundational content

- Build your “Trust Reservoir”: 3 authentic testimonials > 100 vague endorsements

🏺 My Pandemic Pivot: With warehouses locked, I wrote “The Zellige Blueprint”. It became my port, attracting opportunities while I slept.

Principle 2: Plant Patient Trees—Create Assets That Endure

The Olive Wisdom: Olive trees take years to mature but bear fruit for centuries. My grandfather planted trees he knew only his grandchildren would harvest.

Modern Application:

Shift from pure service work to creating digital assets using the Rooted Nomadism approach—building things that outlive individual projects:

| Asset Type | Growth Time | Yield | Example |

|---|---|---|---|

| Saplings | 1-3 months | Occasional | Notion template ($19) |

| Young Trees | 3-6 months | Recurring | Email course ($97) |

| Mature Groves | 1-2 years | Automated | SaaS tool ($29/mo) |

Start Small: Use “Seed Bombing”—spend 90 minutes creating a $7 PDF checklist from existing knowledge. Sell via simple platforms like Gumroad. Reinforce 20% into your Resilience Fund.

Principle 3: Diversify Your Harvest—Multiple Streams, One Ecosystem

The Olive Wisdom: Traditional groves yield oil, table olives, wood, and leaves—multiple products from one system. Single-income freelancers are like farmers selling only oil.

Build Your Resilience Matrix:

- Active Income (60-80%): Client services (your “olive oil”)

- Semi-Passive (15-30%): Digital products (“table olives”)

- Passive (5-10%): Affiliates/investments (“olive wood crafts”)

- Legacy (1-5%): IP licensing (“grove tours”)

💡 Track Your Progress: Use the Root Depth Ratio:

(Semi-Passive + Passive Income) ÷ Total Income

Target: > 0.3 within 12 months

Principle 4: Dig Your Resilience Well—Strategic Financial Reserves

The Olive Wisdom: Olive trees survive droughts through deep roots tapping hidden aquifers. Your emergency fund isn’t for emergencies—it’s strategic resilience capital.

What It Enables:

- Saying “no” to toxic $200/hr clients

- Funding 3-month “asset sprints” without income pressure

- Sleeping through market crashes

- Embracing the Jbala Resilience Quartet mindset

Build It systematically:

Technical Insight: Dr. Samuel Chen, Behavioral Economics, MIT

“Automating savings creates what we call ‘frictionless resilience’—our research shows automated savers build emergency funds 3.2x faster than manual savers. The Olive Grove system leverages this through systematic allocation.”

📊 From Barren Ground to Bountiful Grove: A Real Transformation

March 2020:

- Forager Ratio: 0.98 (98% active income)

- Resilience Fund: 1.2 months

Today:

- Soil:

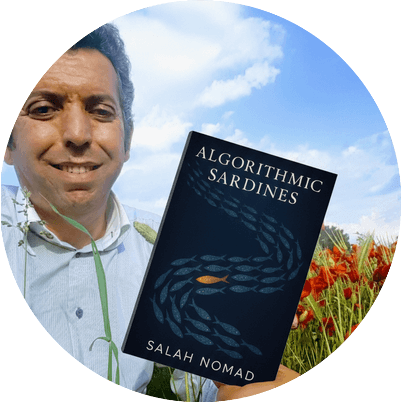

salahnomad.com(28k monthly readers) - Trees: 3 pillar articles → 2 e-books → 1 cohort course

- Harvest Streams: Consulting (55%), Products (30%), Affiliates (15%)

- Root Depth Ratio: 0.45

- Resilience Fund: 14 months

The Transformation Journey:

🚀 Your 7-Day Olive Grove Starter Challenge

Day 1-2: Soil Audit

Map your current “financial ecosystem” and calculate your Root Depth Ratio

Day 3-4: Plant Your First Seed

Create one micro-asset: Checklist, template, or 500-word “pillar seedling”

Day 5-6: Irrigate Your Well

Open separate bank account and automate $20/week transfer

Day 7: Prune for Growth

Eliminate one “low-hanging fruit” client consuming disproportionate energy

🌱 Share your #OliveGroveJourney

I’ll personally critique 5 entries from our community

🌟 The Unshakeable Gardener Mindset

Last month, I received an email: “Your course generated $3,200 while you slept.” Outside, storm winds bent young olive trees. Inside, I drank mint tea, watching rain lash the grove that taught me true wealth.

The forager fears storms.

The gardener plants in them.

Your financial freedom doesn’t live in next month’s invoice. It grows in the assets you plant today—patiently, persistently, like my ancestors tending trees they’d never harvest.

FAQ: Growing Your Financial Grove

How can I start building assets when I'm barely covering expenses?

Isn't this just another passive income scheme?

What's the most important first step I can take today?

Reflective:

What’s one digital asset you could create from knowledge you already have?

Active:

- Calculate your current Root Depth Ratio

- Create one micro-asset this week

- Share your progress with #OliveGroveEconomy

“The best time to plant an olive tree was 20 years ago. The second best time is now.”

— Mediterranean wisdom

Comments